- #Quickbooks 2015 tutorial to split reporting pro

- #Quickbooks 2015 tutorial to split reporting password

You should set up classes for each program, as well as management and general and fundraising. Classes provide a way for organizations to track these expenses. Generally accepted accounting principles require nonprofit organizations to report expenses by function: program, management and general, and fundraising.

This will help to prevent unauthorized access to the organization’s financial information.

#Quickbooks 2015 tutorial to split reporting password

Here are a few additional QuickBooks tips for nonprofits: Recording pledges in QuickBooks varies depending on whether the organization keeps its accounting records on the accrual or cash basis of accounting. The best way to record donated goods and services in QuickBooks is through a journal entry.īe sure to record promises to give or pledges so you can keep track of planned donations. Donated services are recorded as revenues and as additions to nonfinancial assets (if related to a nonfinancial asset) or expense. Donated services should be recorded at fair value if the services a) create or enhance a nonfinancial asset or b) involve specialized skills – provided by entities possessing those skills – that would be purchased if they were not donated. Donated goods should be recorded as revenue and as inventory or expense (whichever is appropriate) at fair value in the period in which they are received. In addition to monetary contributions, nonprofits often receive donated goods and services. Consequently, such donations generally should be entered as cash sales. However, deposits do not allow users to track items (the account is entered rather than the item) or generate a cash receipt. Nonprofit organizations that receive financial donations that were not invoiced may enter them in QuickBooks either as a deposit or a cash sale. A notes option is available to track and record information about the volunteers. It’s a good idea to track volunteers separately from members, donors and clients, which you can do by entering their information in the “Other Names List.” Volunteers who are already listed as members, donors or clients will need to be entered with a slight name variation (for example, John Smith “Member” versus John Smith “Volunteer”). Tracking volunteers for nonprofit organizations is also important for nonprofits, which rely heavily on this extra help. You can print reports, labels, and summary statements by customer type. For example, you might want to track type of contributor or member (sponsor, donor, patron, or subscriber) location of contributor or member industry represented by donor or member or type of services provided to clients. Nonprofit organizations may find it useful to track and report members, donors and clients by type. Make sure to keep up-to-date address information so you can easily generate letters and track important information for donors. You can add custom fields in the “Additional Info” tab to track meaningful data. –Enter the organization’s members, donors, and clients in the “Customer: Job List” field so you can keep track of their information. Tracking nonprofit information in QuickBooks

#Quickbooks 2015 tutorial to split reporting pro

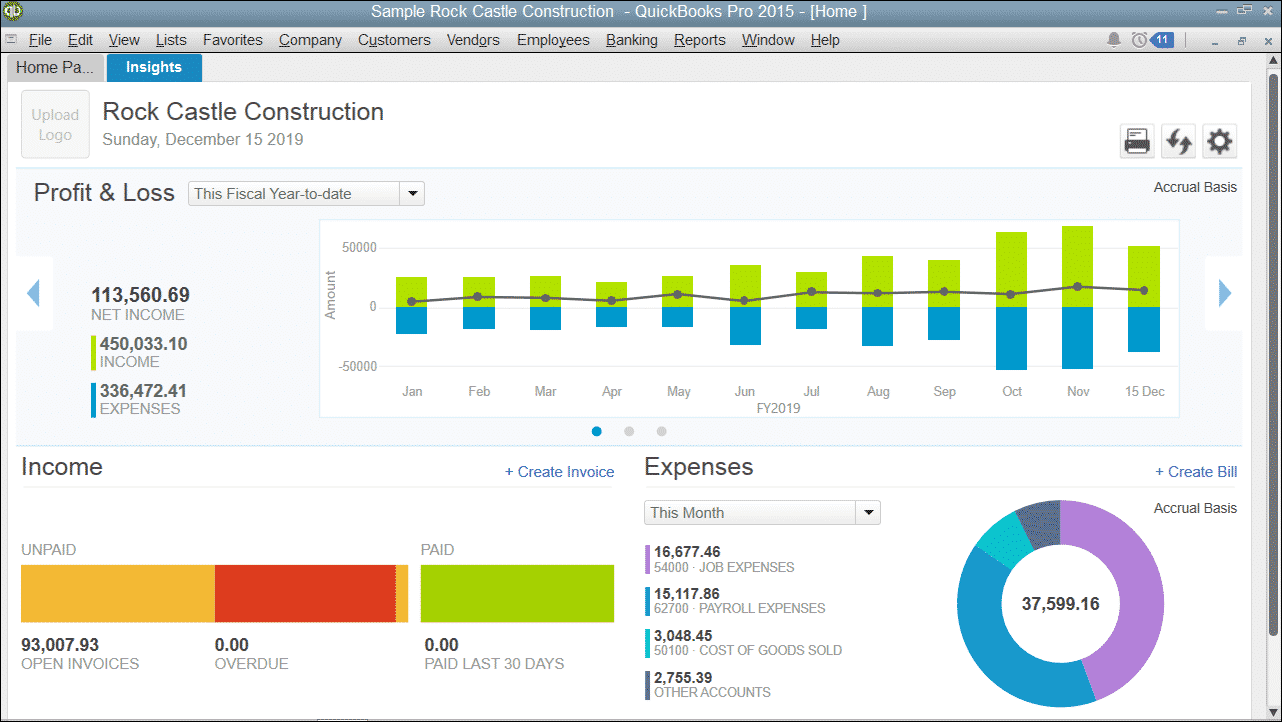

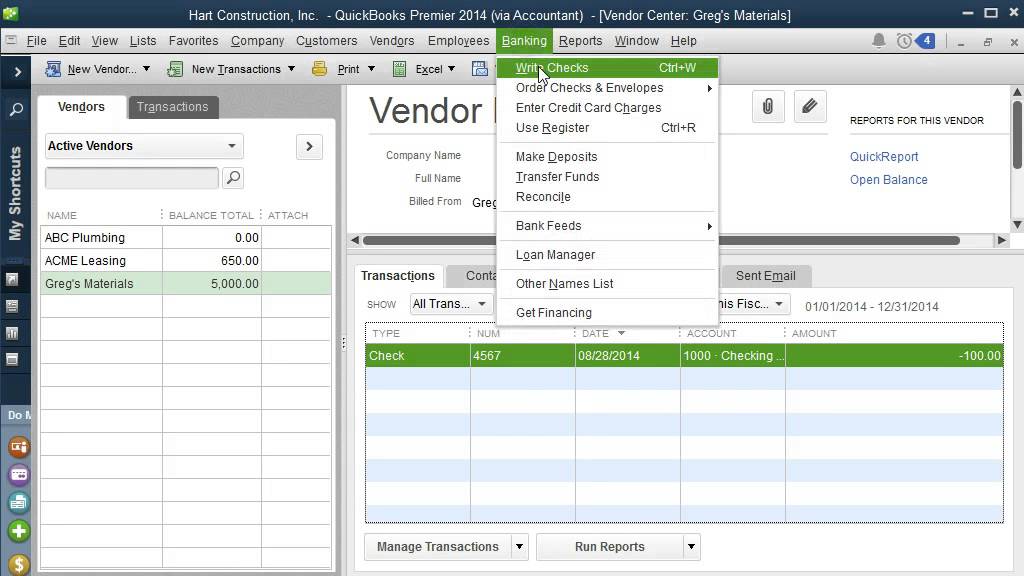

By reworking some of the names in QuickBooks, nonprofits can use the standard QuickBooks Pro without having to spend extra for the official nonprofit edition. For example, the “Biggest Donors” label in QuickBooks Nonprofit is the same as “Sales by Customer” in QuickBooks Pro. When it comes time to run reports, the standard QuickBooks reporting function creates the same reports as the QuickBooks Nonprofit edition, with the only difference being the labels.

Likewise, the “Create Invoice” field can be replaced with “Enter Pledges” to meet the nonprofit’s needs. For example, a label called “Create a Sales Receipt” in QuickBooks Pro is the equivalent of the “Enter Donations” label in QuickBooks Nonprofit. The good news is, there is another option: You can customize the set-up of the traditional versions of QuickBooks – including QuickBooks Online – to meet the needs of a nonprofit organization.įor starters, nonprofit organizations can rename QuickBooks labels to reflect their terminology. However, QuickBooks can be a valuable tool for both types of organizations.Īlthough QuickBooks does offer the Premier Nonprofit edition that incorporates nonprofit-specific language and features, it does cost more than the standard version.

Nonprofits focus on generating funding while for-profits focus on sales and increasing the bottom line. Nonprofit organizations have different tax reporting and financial reporting requirements than traditional for-profit businesses and different accounting needs.

0 kommentar(er)

0 kommentar(er)